https://www.pexels.com/photo/business-research-document-paper-8962468/

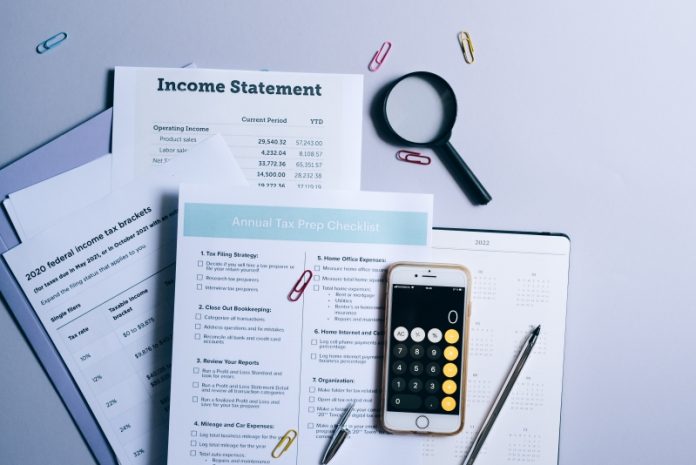

Financial management is essential for a business’s survival and development. It is necessary to plan, organise, regulate, and manage your financial resources as a brand to achieve your business objectives. Financial management may help your organisation better use resources, meet stakeholder commitments, acquire a competitive edge, and plan for long-term financial stability. That said, here are some practical tips to help you secure your business finances.

Keep a cash reserve

An emergency cash reserve for your business can function similarly to a savings account, allowing you to aid yourself in times of need when there is no other option. This is important for businesses since you never know when an emergency will arise; you may face financial difficulties if you have invested all of your earnings. Continue to set aside a portion of your profits to cover uncertain or difficult times.

Efficient bookkeeping

It is crucial to keep up with your accounts and ensure they are updated. If you don’t keep track of late customer payments or know when to pay your suppliers, you could lose valuable money and damage your business’s financial future. Take a look at the financial and management accounts. Using an intelligent record-keeping system, you can keep track of spending, debts, and creditors, request additional funding and save time and money.

Use professionals for your financial management needs

Financial troubles in a business are always stressful. Still, there is always sound professional advice available to help you deal with them before they become too much to bear and you incur expensive mistakes. You can also take some preliminary efforts to reduce the impact, such as addressing significant debts first and examining how you might improve your cash flow management. Using professionals for your financial management needs can be beneficial for your organisation in many ways. For example, effective payroll accountants will ensure the economical processing of all your monthly payrolls.

Fulfil tax payment before deadlines

Failure to file tax returns and payments by the dates can result in fines and added interest payments. These are avoidable expenses that may be avoided with a bit of planning ahead of time. Maintaining proper records saves time and money for your business, and you can rest assured that you’re just paying the taxes you owe. As a result, you must follow through on your responsibilities.

Be operationally efficient

Is your business functioning at its highest capacity? By changing one’s behaviour and utilising current equipment more efficiently, one can save energy and thus money. It’s a simple method to save money. Heating, lighting, office equipment, and air conditioning are all areas to consider in a typical office.

Budgeting and efficient allocation of funds

Without a budget, no firm or individual with restricted resources can function. Budgeting makes everything more effective and helps you stay on track with your goals. You will be less anxious when managing your business and spending since you know exactly how much money is spent and what goods. Make a budget for all expenses and calculate earnings for both the business and yourself.